The contribution rates for employees and employers can be obtained by referring to the Third Schedule of the EPF Act 1991 EPF said in a statement. SIP EIS Table.

Life Expectancy And Mortality Rates In Malaysia Download Table

The contribution rates for employees and employers can be obtained by referring to the Third Schedule of the EPF Act 1991 EPF said in a statement.

. The Employees Provident Fund EPF informs that the reduction of the statutory contribution rate for employees share to eight 8 per cent which started for March 2016 wagesalary April contribution will end at the end of December 2017 wagesalary January 2018 contributionThe reduction of contribution rate was announced by the Government in 2016 following the tabling. Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550. Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule.

Contribution rate for both employee and h empl oyer is limi ed 10 p erc nt. The minimum administrative charge is Rs. The Employees Provident Fund EPF informs that the reduction of the statutory contribution rate for employees share to eight 8 per cent which started for March 2016 wagesalary April contribution will end at the end of December 2017 wagesalary January 2018 contributionThe reduction of contribution rate was announced by the Government in 2016.

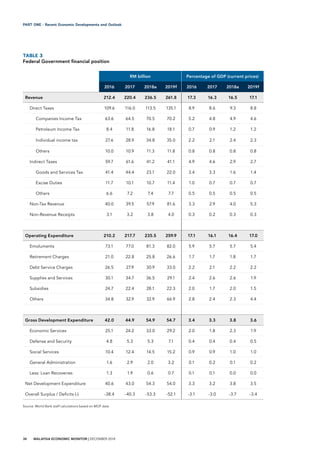

RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 001 to 1000 NIL NIL NIL From 1001 to 2000 300 200 500 From 2001. Jadual PCB 2020 PCB Table 2018. The rate of monthly contributions specified in this Part shall apply to the following.

Epf Contribution Table 2018 Get link. THIRD SCHEDULE Sections 43. The Employees Provident Fund Act 1991 is amended by substituting for the Third Schedule the following schedule.

AMOUNT OF WAGES RATE OF CONTRIBUTION FOR THE MONTH FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 52001 to 54000 7100 6000 13100 From 54001 to 56000 7300 6200 13500 From 56001 to 58000 7600 6400 14000 From 58001 to 60000 7800 6600 14400. 1997 was issued enhancing Provident Fund. THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1.

Wages up to RM30. EPF is administered by the EPFO employee provident fund organization established by the government of India and employee and employer has to. 2 This Order comes into operation on 1 January 2018.

Jadual PCB 2020 PCB Table 2018. EPF contributions tax relief up to RM4000 this is already taken into consideration by the salary calculator Life insurance premiums and takaful relief up to RM3000. Contribution By Employer Only.

Instead the statutory contribution rate for employees share will revert to the original 11 for members below the age of 60 and 55 for. EPF contributions tax relief up to RM4000 this is already taken into consideration by the salary calculator Life insurance premiums and takaful relief up to RM3000. EPF contribution April 2018 Rs 7835.

The new rate will be effective for salaries from January 2018 onwards February 2018 EPF contribution EPF said in a statement today. When wages exceed RM30 but not RM50. Examples of Allowable Deduction are.

Item 2018 2017 Change Total Gross Income 222843 223192016 Less. If there is no contribution for a. Third Schedule Order 2017.

Amendment of Third Schedule 2. The following table shows the EPF interest rate for the 10 years Financial Year. Effective January 2018 cycle February 2018 EPF.

The above the employer has to pay an additional charge for administrative accounts which are in effect from 1st June 2018. It added that members who wished to contribute more than the statutory rate of 11 or 55 may do so by completing Form KWSP 17A AHL or Form KWSP 17AA AHL. With this 172 categories of.

For example if the monthly basic salary is Rs 30000 the employee contribution towards his or her EPF would be Rs 3600 a month. For most employees of the private sector its the basic salary on which the contribution is calculated. THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1.

The page is not found. 01-04-2017 10 rate is applicable for. When wages exceed RM100.

EPF Contribution Third Schedule. EPF contribution is the abbreviated form for employee provident fund contributionEPF contribution is an amount contributed towards the EPF scheme for the post-retirement benefits of the employee. RM1580 when you include your employers contribution.

The remuneration or payable to employees are subject to SOCSO.

Important Dates Deadlines For Aadhaar Linking With Pan Mutual Funds Insurance Policies Mobile Sim Investment In India Important Dates Mutuals Funds

20 Kwsp 7 Contribution Rate Png Kwspblogs

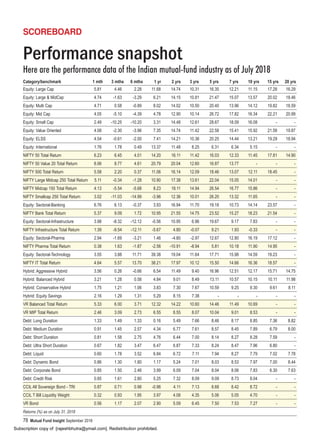

Mutual Funds Insight Sept 2018

Basic Savings Table Epf For Unit Trust Consultant 2018 Myunittrust Com

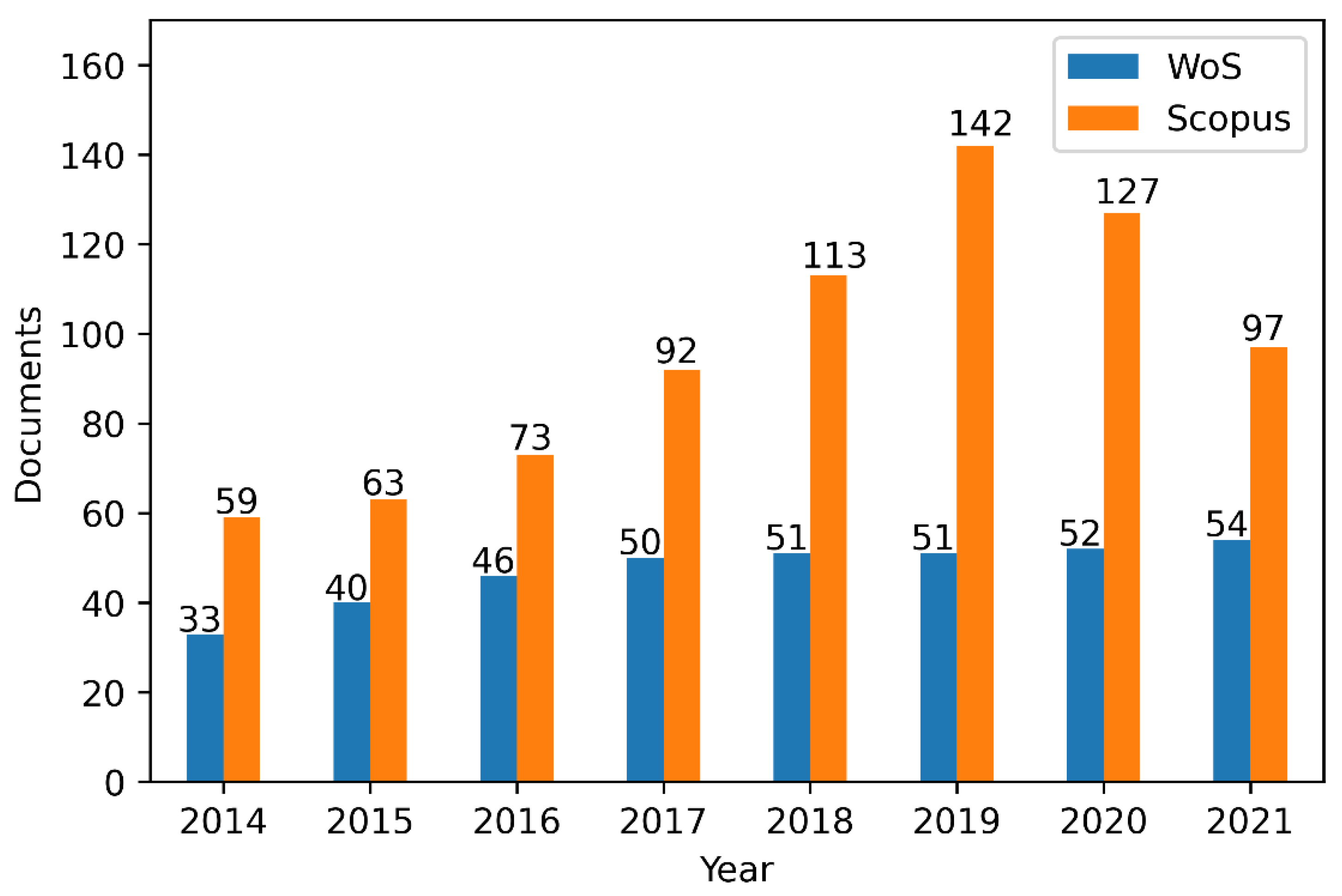

Energies Free Full Text Models Of Electricity Price Forecasting Bibliometric Research Html

Socioeconomic And Health Impacts Of Fall Armyworm In Ethiopia Plos One

Important Dates Deadlines For Aadhaar Linking With Pan Mutual Funds Insurance Policies Mobile Sim Investment In India Important Dates Mutuals Funds

Epf Contribution Rates 1952 2009 Download Table

Mutual Funds Insight Sept 2018

30 Nov 2020 Bar Chart Chart 10 Things

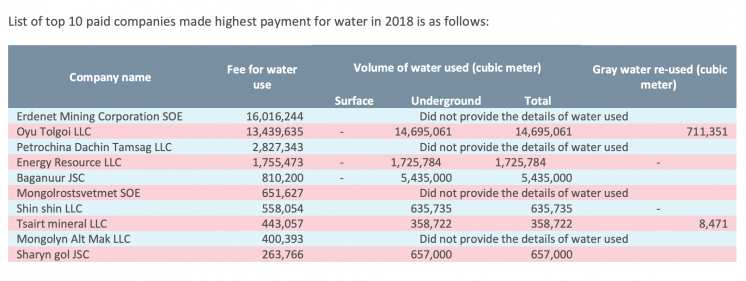

Social And Environmental Expenditures Eiti

What Is The Epf Contribution Rate Table Wisdom Jobs India

Chamber Of Deputies Election Results 2013 And 2018 Download Scientific Diagram

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Pin On Epf Kwap Ltat Lth Pnb Ptptn

Income Tax For Fy 2018 19 Or Ay 2019 20